A company’s business results are directly related to the creditworthiness and payment behavior of its business partners. Efficient credit management reduces the risk of payment defaults and thus makes a positive contribution to the operating result. SAP Credit Management in SAP S/4HANA supports companies in structuring and optimizing credit management processes. On the one hand, this makes it possible to identify default risks at an early stage, for example, on the basis of past customer payment behavior. On the other hand, strategies for optimizing business relationships with customers can be derived and implemented in order to prevent possible non-payment risks. Examples include issuing reminders, negotiating payment terms, or providing advance payment for customers who may not be able to meet their future payment obligations. This minimizes financial defaults as well as the time- and resource-consuming intensive support of business partners. We will show you the most important processes available in SAP Credit Management.

Do you want to identify potential default risks of your business partners in time?

The benefits of SAP Credit Management at a glance

-

Minimization of payment defaults

-

Focus on creditworthy and reliable business partners

-

Fast and uncomplicated processes

-

Efficient and automated credit decisions

-

Improved decision quality, as credit decisions can be made by decision-makers with the appropriate competencies and authorizations

-

Establishment of central credit management in a multi-system landscape

-

Automated calculation or derivation of internal credit rating, risk class and credit limit

-

Storage of external ratings by linking external credit information, e.g. Creditreform

-

No need to use third-party products, as all processes run in SAP

Creditworthiness-relevant check processes for the business partner

Automatic calculation of internal creditworthiness

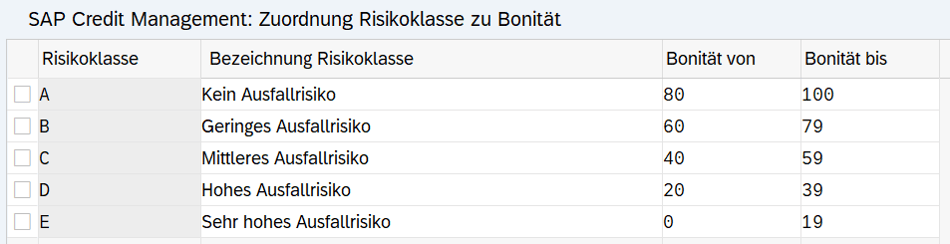

In a credit check, creditworthiness or credit standing represents the most important basis for decision-making. Creditworthiness is indicated by means of a score, which is calculated on the basis of various individually defined criteria. This score can be used to map the probability of default on outstanding payments for each customer. In turn, a specific risk class can be derived from a specific creditworthiness or a specific score.

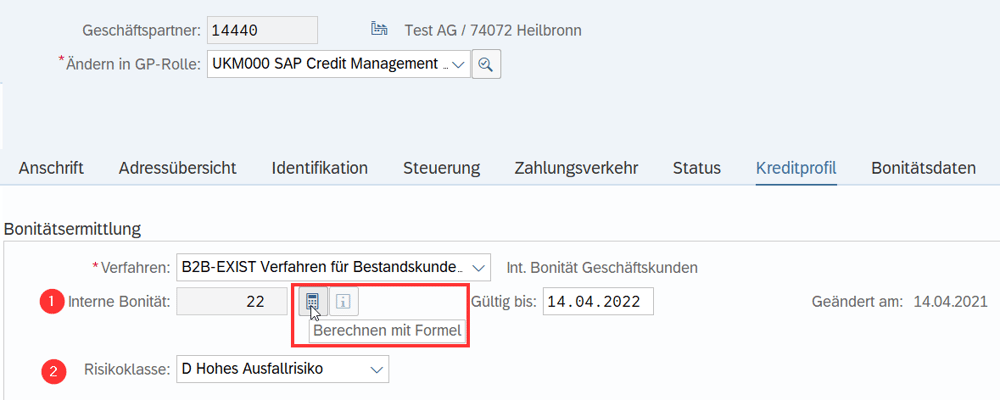

In SAP Advanced Credit Management, the credit officer can have a customer’s internal credit rating (1), risk class (2) and credit limit calculated automatically at the push of a button.

The internal creditworthiness is based on an individually configurable scorecard with certain weighted credit parameters, which can be implemented accordingly in the formula editor for calculating the creditworthiness. The previously defined risk class is automatically derived from the internal credit rating. The score is assigned to a specific risk class. This gives the credit officer a better assessment of the payment risk.

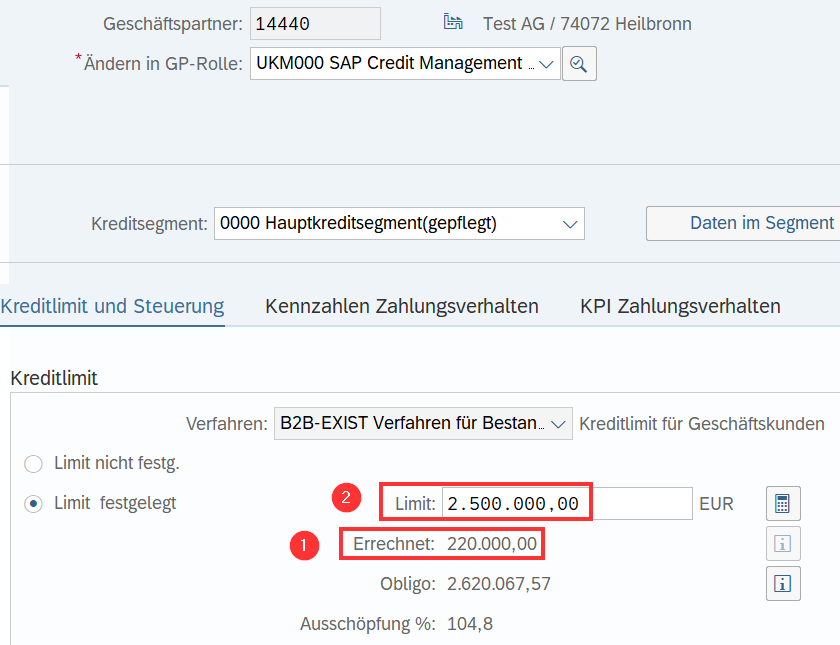

The credit limit is automatically calculated from the internal credit rating. Here, too, a formula has to be defined and a corresponding customizing has to be set up..

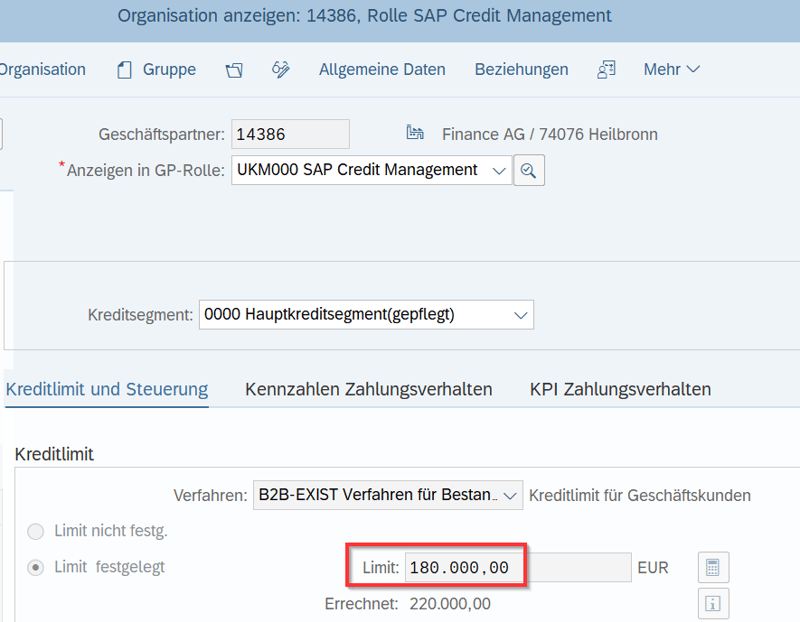

The automatically calculated credit limit (1) can be overwritten manually (2) at any time, which is why the credit officer has control over the credit limit entered.

Determining creditworthiness with external rating

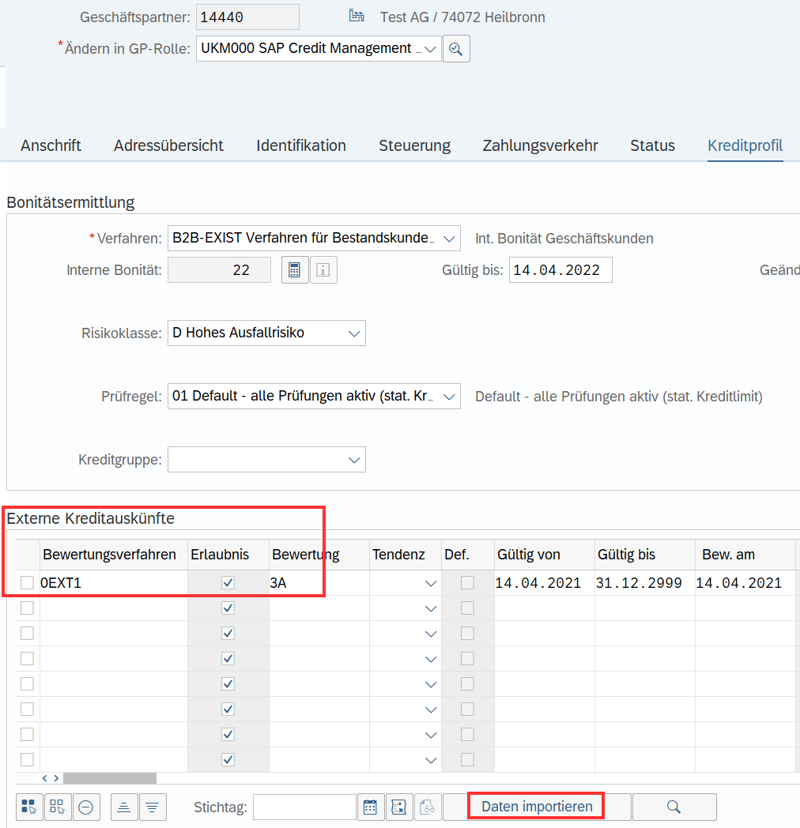

Another option for determining creditworthiness is offered by SAP Advanced Credit Management with the connection to external credit agencies, for example Creditreform. By querying and saving external ratings, these can also be used to calculate internal creditworthiness and the credit limit. This is referred to as a mixed procedure for determining creditworthiness.

The credit officer imports creditworthiness data from external credit reports into Business Partner. The data can subsequently be processed using various procedures for determining creditworthiness.

Processes of credit limit requests

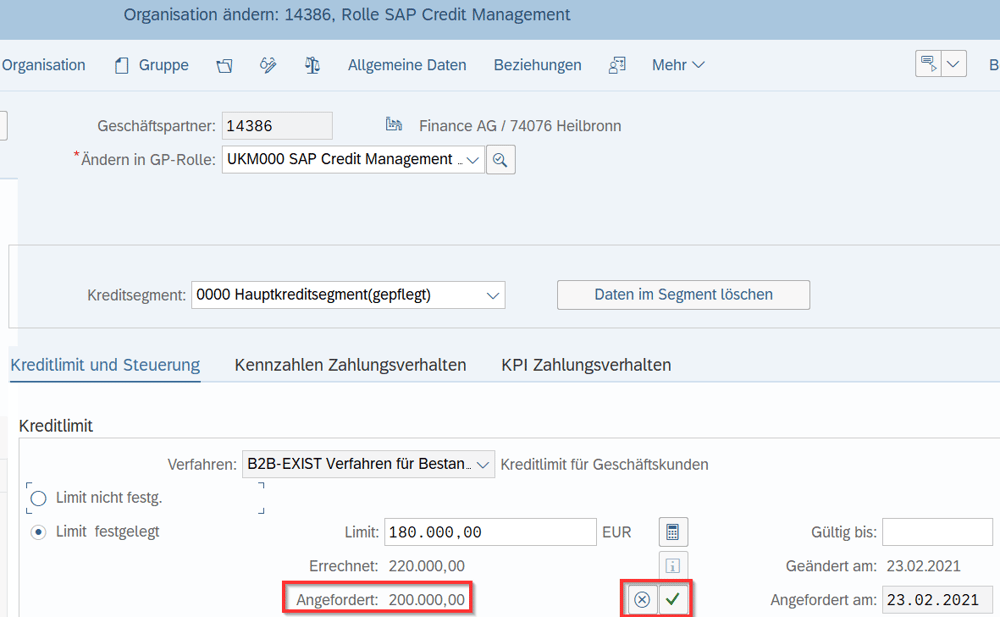

A credit limit of 180,000 euros has been set for the fictitious business partner Finance AG. Management and sales push the cooperation with Finance AG and have landed a new order. A sales employee then checks the credit data of the business partner and realizes that if the sales order were entered, the current credit limit of 180,000 euros would not be sufficient and, as a result, the newly entered sales order would be blocked due to the deposited credit check.

Since the sales employee expects more Finance AG orders in the future, he would like to increase the credit limit to 200,000 euros. He has to apply for the increase to the credit officer.

Credit limit request in Case Management

This process is particularly suitable for companies with separate areas of competence for master data maintenance and credit management. This means that requesters and decision-makers of the credit limit request, for example sales employees and credit officers, do not have authorization for master data maintenance of the business partner. In order to be able to use the functionalities of the credit limit request in Case Management, appropriate configurations are necessary in customizing and in the assignment of authorizations.

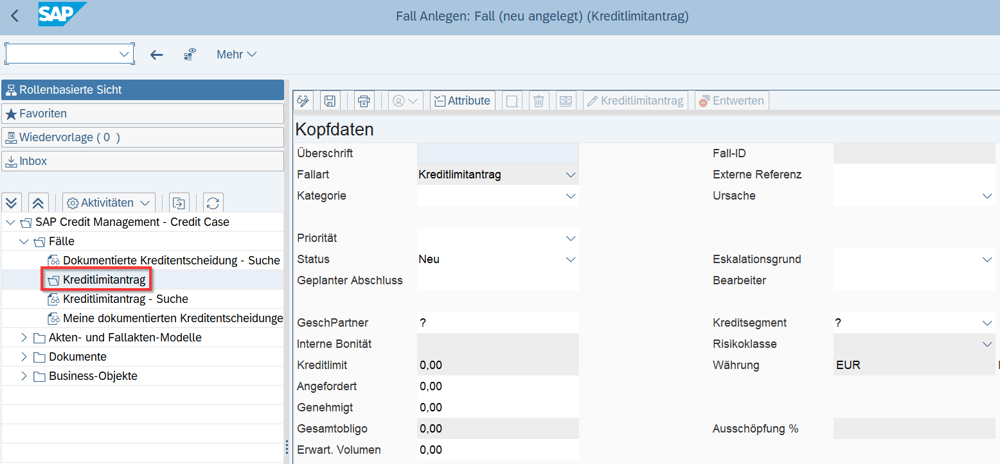

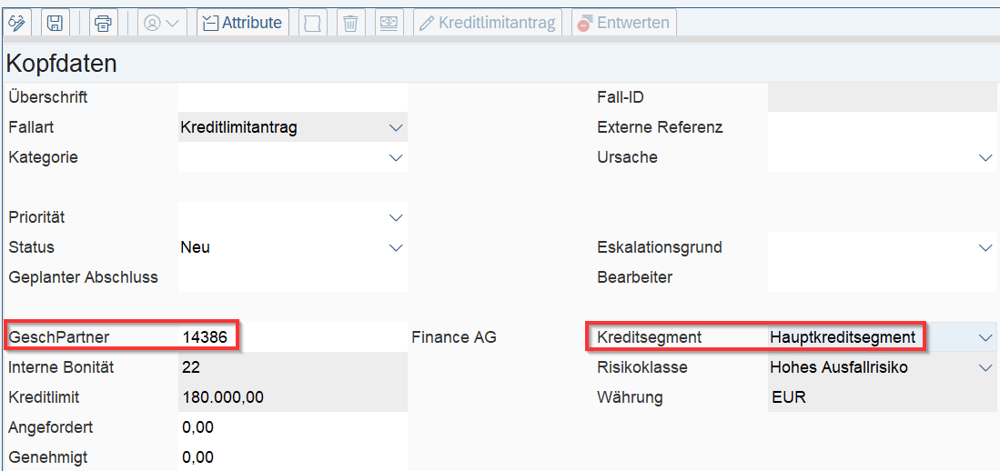

To create a credit limit request, the sales employee calls up the SAP Case Management component using transaction UKM_CASE. In the folder “Credit limit request” he enters the business partner number and the corresponding credit segment.

After confirming with the Enter key, all credit master data from the business partner are automatically populated. They can be seen in the fields highlighted in gray.

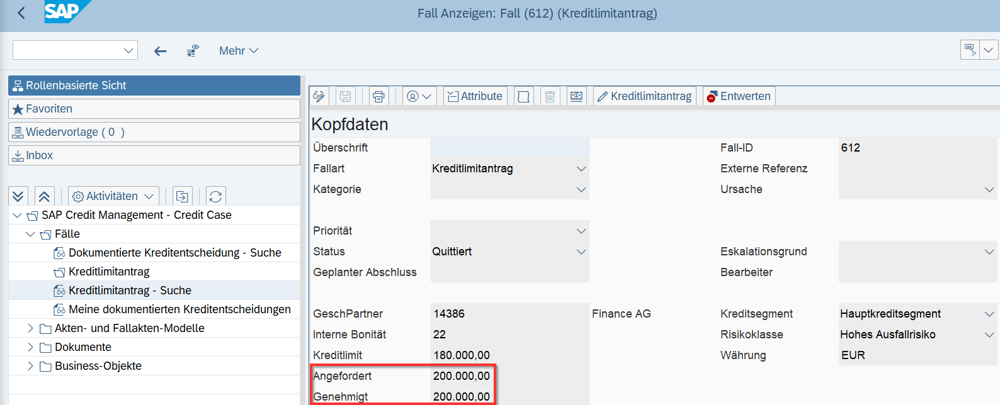

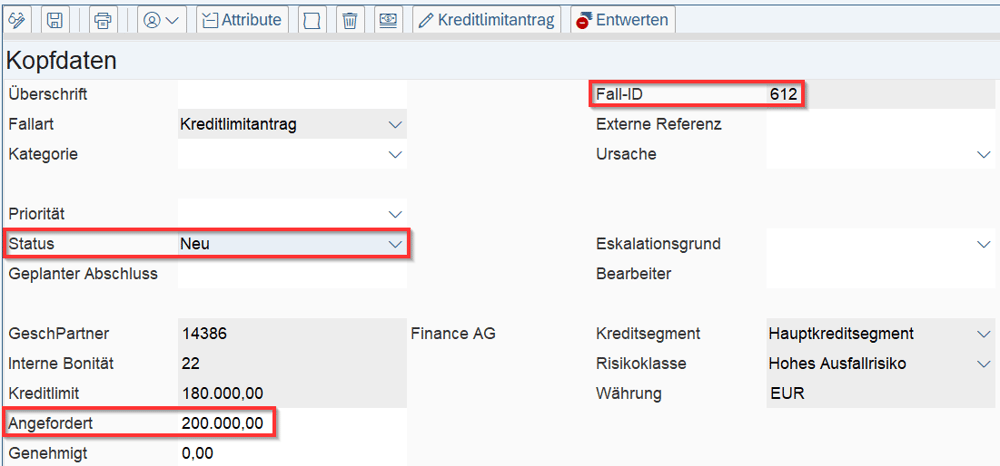

In the next step, the sales representative enters the requested credit limit. When saved, the credit limit request is created, a case ID is automatically generated, assigned to the credit limit request and the status is set to “New”.

The credit officer of Finance AG sees in the search of the credit limit requests on the basis of the system status “open/new” that there is a new case to process. He then opens the new credit limit request, sets the status to “In process” and saves the new status.

After checking the Business Partner, the credit officer has the following options: The credit limit request is approved or the credit limit request is rejected.

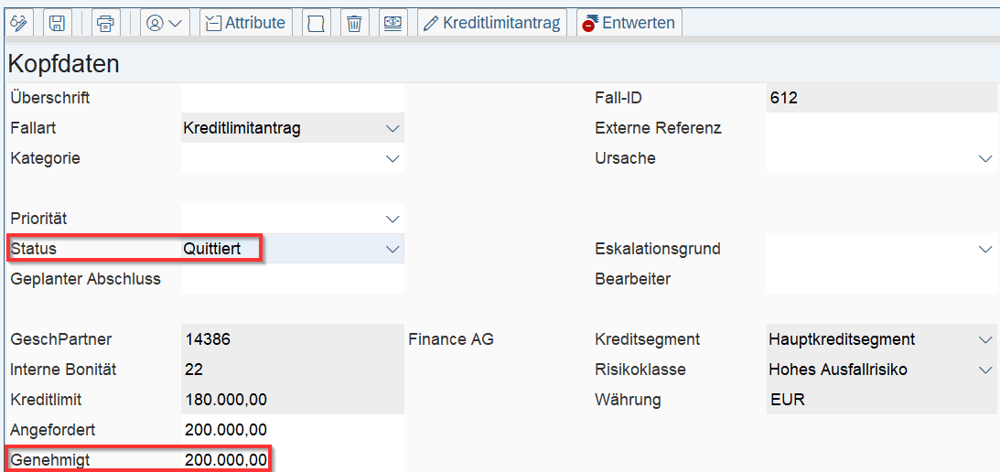

Option 1: Approve credit limit request

To approve the credit limit request, the credit officer enters the credit limit he/she has approved, which may differ from the requested credit limit, sets the status to “Acknowledged” and saves the credit limit request. The request can now no longer be processed. In the Business Partner, the credit limit is automatically changed to the approved amount of 200,000 euros. If the approved amount differs from the requested amount in the credit limit request, the approved amount is always transferred to the Business Partner.

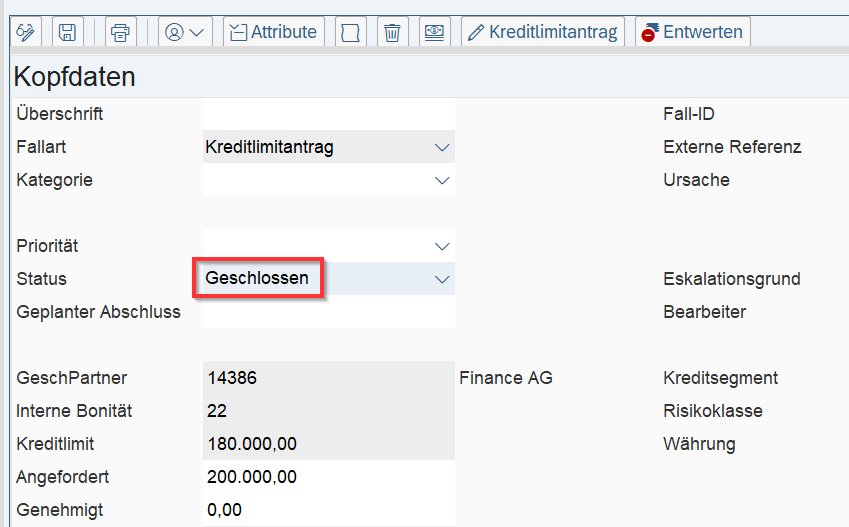

Option 2: Reject credit limit request

If the credit officer decides to reject the credit limit request, he sets the status to “Closed”. In this case, the credit limit request cannot be processed any further.

Credit limit request in the Business Partner

The process of the credit limit request in the Business Partner requires the corresponding authorizations of the employees to process a Business Partner and to use workflows. In addition, appropriate customizing adjustments are necessary.

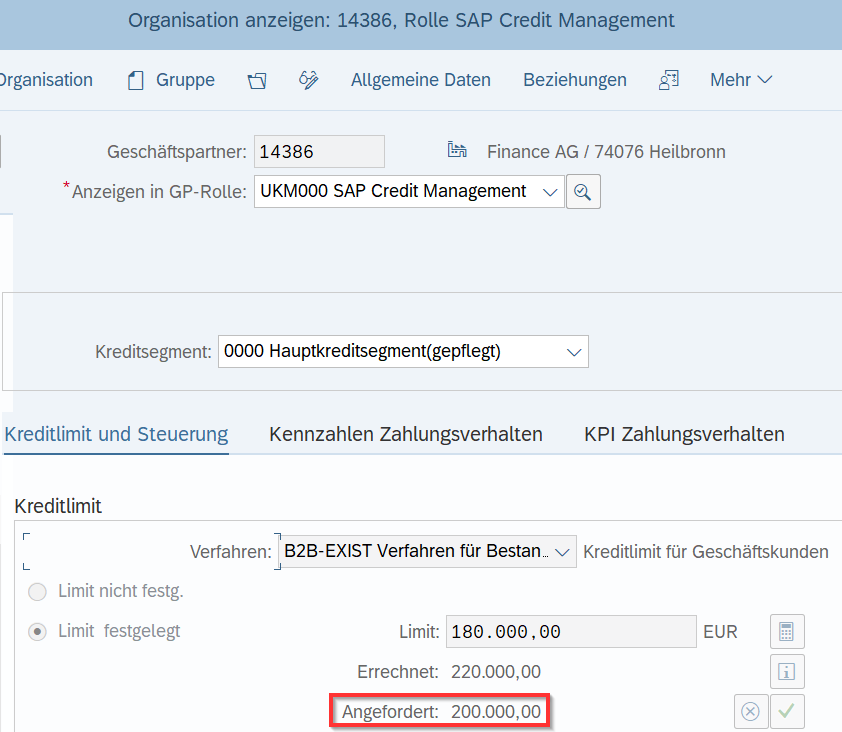

The sales employee expects more orders from Finance AG in the future and therefore wants to adjust the credit limit to 200,000 euros. Accordingly, the sales employee processes the Business Partner by entering the new credit limit of 200,000 euros.

When the credit limit of a credit account is increased manually or by an automatic process, such as a mass change, the system does not immediately transfer the increased value to the “credit limit” field, but to the “requested” field. At the same time, a workflow is generated that informs the responsible credit officer of this request and provides a jump to Business Partner maintenance. In transaction UKM_CASE, the credit officer finds his workflows in the inbox. If authorized, the credit officer can accept or reject the requested credit limit.

Option 1: Credit limit request is accepted

If the credit officer accepts the requested credit limit, the sales representative receives an information about the credit limit increase.

Option 2: Credit limit request is rejected

If the credit officer rejects the requested credit limit, the old credit limit remains in place and the sales representative receives information about the rejection of the credit limit request.

Processes of the credit check

Documented credit decision

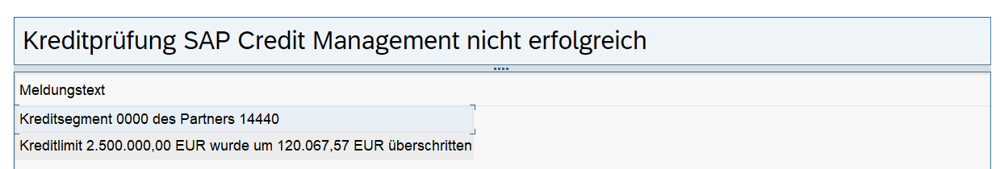

A sales employee has concluded a new order with the fictitious customer Test AG. He creates the sales order in the system. In case of a negative credit check, a warning message is issued, the sales order is blocked and a workflow, the documented credit decision, is created. Due to the credit block, the sales order and possible subsequent processes such as deliveries cannot be processed further.

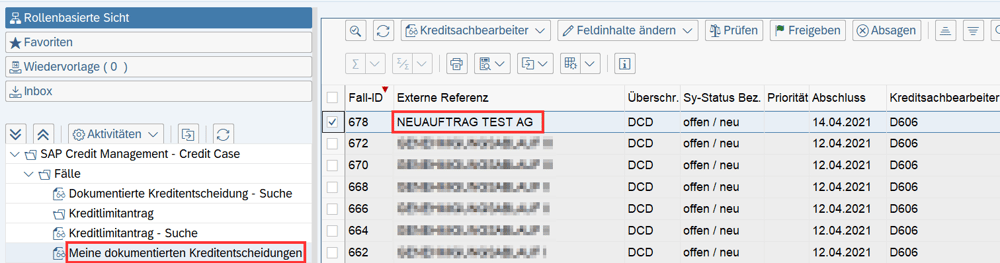

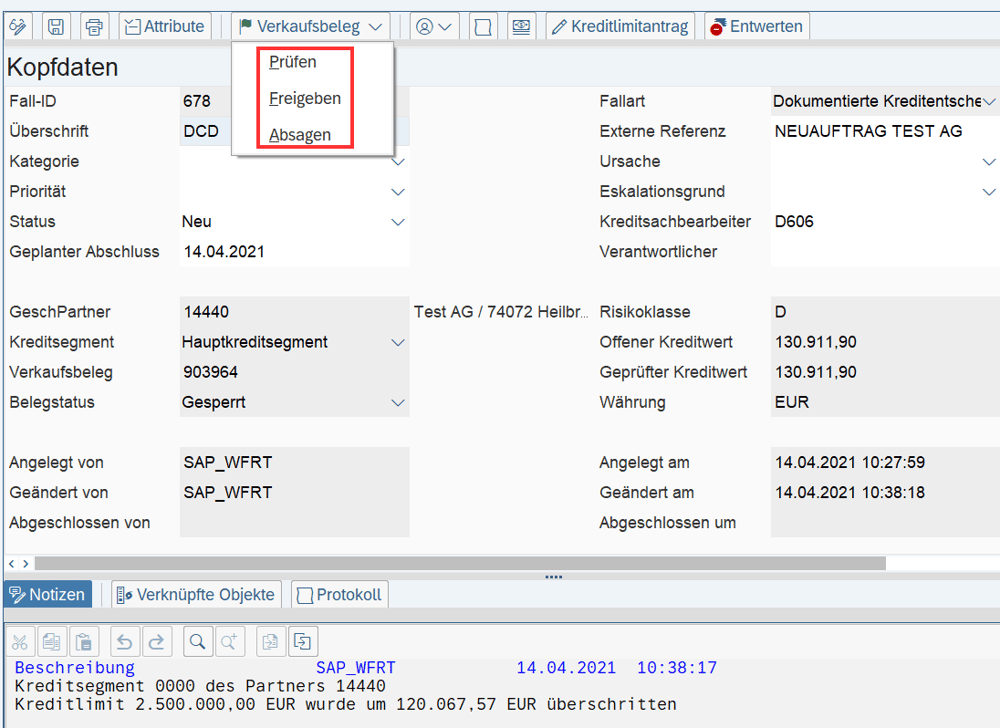

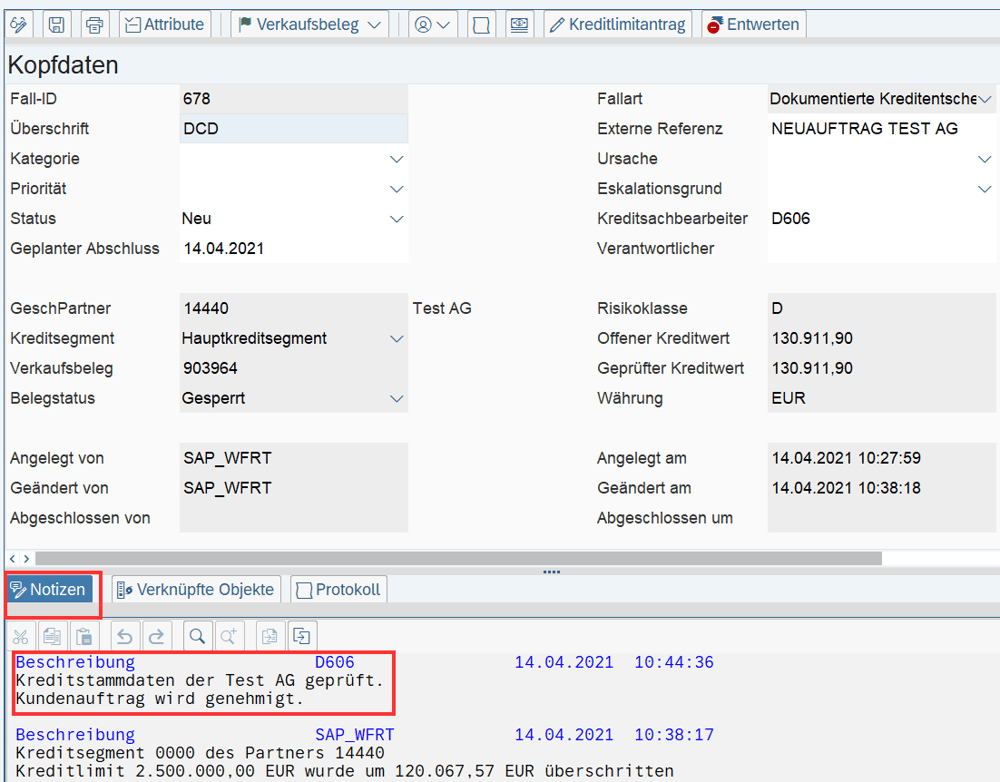

The credit officer opens the documented credit decision in the Case Management component and has the option to approve or reject the sales order or have it rechecked.

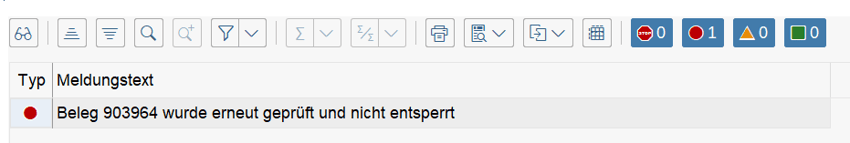

Re-checking the document can, under certain circumstances, lead to an approval if, for example, the Business Partner’s credit limit has been increased in the meantime, resulting in a positive credit decision. In this case, the credit limit of Test AG was not increased and the following warning message appears during the recheck:

Now the credit officer checks whether the sales order may be approved from a credit-relevant point of view. He can access the credit master data of the business partner, check it and make a decision on this basis. The credit officer comes to the conclusion that the sales order is approved despite exceeding the credit limit because there is already a long-standing business relationship with Test AG and the credit limit overrun is within an acceptable range. Under “Notes”, the credit officer notes the approval of the customer order. In addition, the system logs each credit check, always recording the user and the time and date information.

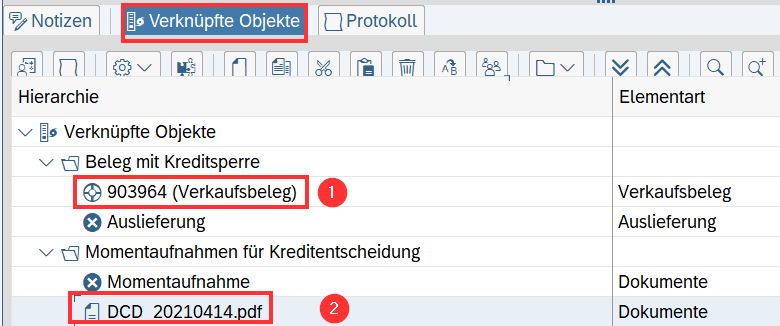

In the “Linked Objects” tab, the credit officer also has the option of jumping directly to the sales order (1) or displaying a snapshot (2) that is automatically generated at the time of a credit check and saved in the documented credit decision in PDF format..

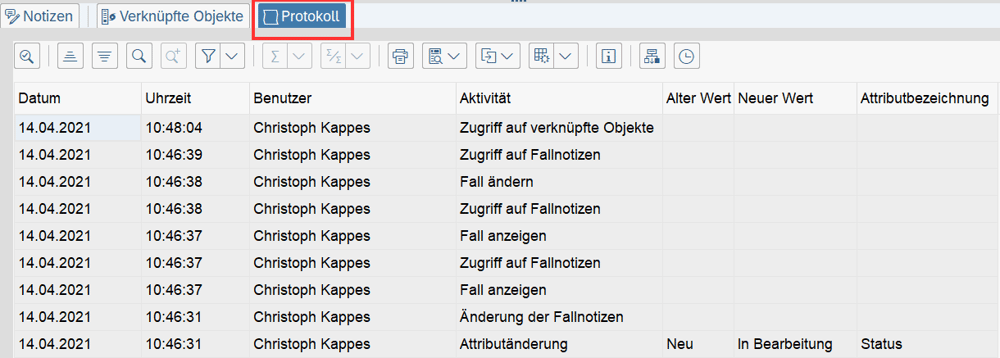

The log displays all steps and activities in the documented credit decision.

In the next step, the credit officer releases the sales order. This is confirmed by a message and logged in the notes. The release based on the documented credit decision has changed the status of the sales order so that it can subsequently be processed further.

![IBacademy_Logo_blau[496] IBacademy_Logo_blau[496]](https://www.ibsolution.com/hs-fs/hubfs/IBacademy_Logo_blau%5B496%5D.jpg?width=200&name=IBacademy_Logo_blau%5B496%5D.jpg)