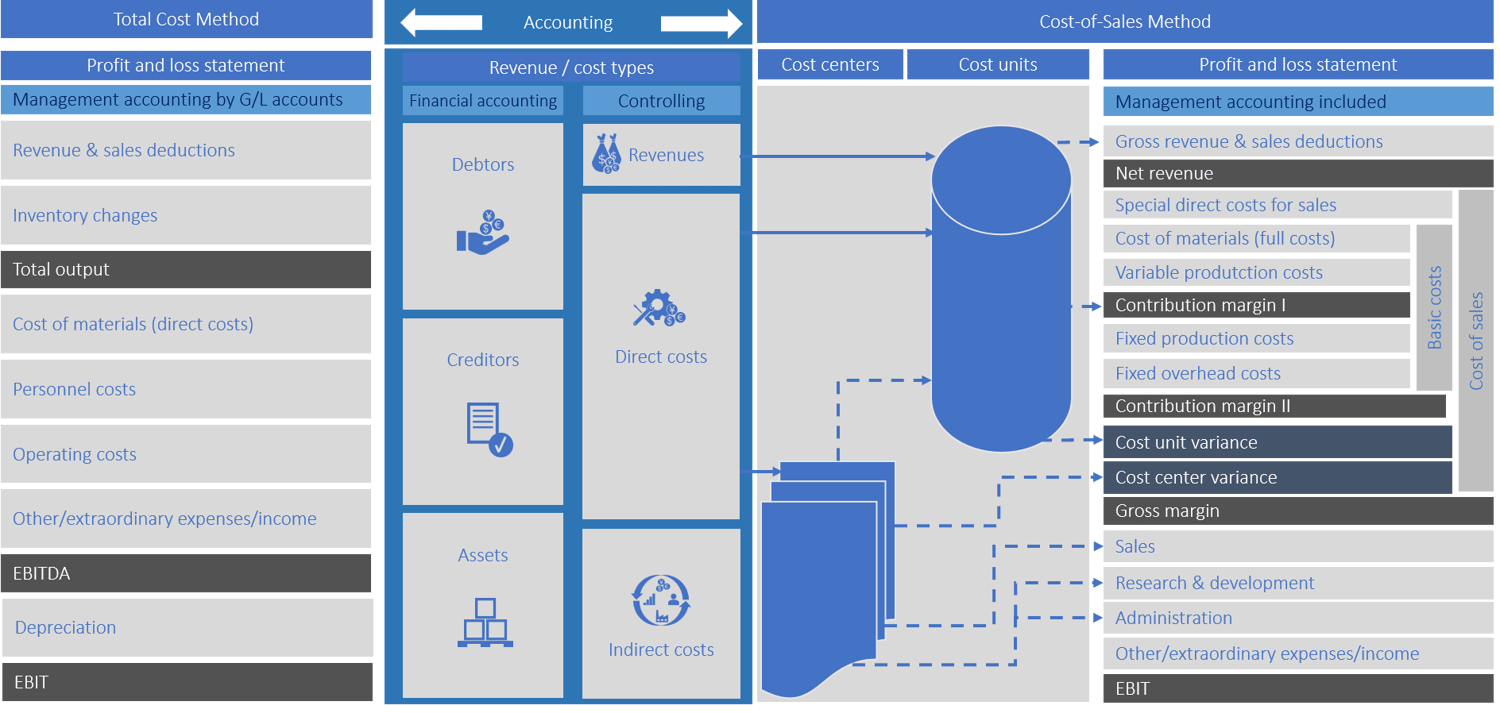

In principle, companies in Germany have two options for preparing their income statements: the cost of production method and the cost-of-sales method. On a global scale, however, the cost-of-sales method is the international standard for accounting.

The cost-of-sales method provides an exact overview of the results of individual products/projects and combines financial accounting with management accounting. Based on a complete transparency of the profitability of individual orders and customers, a conscious prioritization of orders can be made. Overall, the cost-of-sales method supports rapid and strategically oriented company growth.

More transparency about value flows in customer projects and in the organization:

Integration of management accounting

Allocation of costs and services according to originator

Direct and detailed allocation of costs to the individual project/cost object

Visibility of individual value flows, e.g. allocations

Effective and proactive portfolio management thanks to the mapping of a complete picture of projects and their profitability:

Direct comparability of individual projects

Simple margin check and easy co-calculation

⇒ Projects/products with high margins can be brought forward if necessary in order to settle projects with low margins that have to be delivered in the same period (business consistency)

More specific statement of the real value of a project

Increased efficiency and higher speed in processes through simplification, standardization and automation:

More efficient processes through standardized accounting channels

Easier direct and thus originator-based attribution of costs based on allocations

Compensation for the matrix-like increase in complexity through automation potential in SAP processes

Visibility of capacity absorption (under/over) in the cost-of-sales method

Better comparability with international competitors through harmonized accounting:

Use of the cost-of-sales method (IFRS) by all companies reporting internationally

Use of the cost of sales method (US GAAP) by all Anglo-Saxon financial closing

Easier determination of benchmarks with the help of the cost-of-sales method also in German GAAP

It’s easier to establish international networks because it’s easier to compare

Inorganic growth, mergers, easier integration of international acquisitions, easier formation and valuation of joint ventures

Total cost method is only common in Germany

Lack of transparency about value flows

Profitability of the products is only visible via an additional calculation (cost-performance accounting)

Project-related reporting is not provided

Capacity utilization is not recorded

Worldwide standard, thus easy comparison with international competitors

Combination of accounting and cost-performance accounting requirements

Efficient management of portfolios through reporting of specific profitability

Better cost transparency at individual project level

Absorption can be quickly determined and evaluated

Determination of the current G/L accounts

Determination of value flows

Transparency about necessary changes in the chart of accounts

Allocation matrix of cost collectors to cost objects

Development of new mapping for reports

Redefinition of the chart of accounts

Restructuring of the reports

Redefinition of the value flows

New chart of accounts that is capable of cost-of-sales method incl. accounts for cost-performance accounting

Installation and documentation of the new value flows

Creation of mapping for new reports

Implementation of the modified chart of accounts

Creation of the new reports

New setup of the value flows

Availability of the new chart of accounts and reports

New, smooth value flow

Identical result from cost-of-sales method and total cost method, but different presentation

Simulation of a closure in the test system

Cross check to the legacy structure

Consistency of the two parallel prepared financial statements

Release of the cost-of-sales method financial statements

Release after successful testing

User training

Optional: Support during a complete closure

No more need for cost-of-sales method closures

Trained employees

Companies that have been using the total cost method so far should consider switching to the cost-of-sales method. This is because the cost-of-sales method is increasingly becoming an important success factor.

The mechanisms for corporate management have often evolved historically. A closer look at their effectiveness is likely to reveal optimization potential in a large number of companies. Leverage this potential with the Quick Check for Corporate Management by IBsolution.

The social, ecological and economic framework conditions are changing ever faster. These changes have enormous implications for the management of companies. Our study analyzes which parameters will be the most important success factors in corporate management in the future.

Innovative concepts and solution approaches are the basis for mastering current and future challenges in corporate management. With comprehensive consulting expertise and operational business experience, we integrate all relevant fields of action and ensure sustainable project success.

Simply complete the form and submit it. We will get back to you as soon as possible.