Efficient receivables and credit management reduces the risk of financial default and helps to optimize business relationships with business partners. SAP Credit Management, which is mandatory in the course of an SAP S/4HANA conversion, supports you in identifying potential default risks of your business partners at an early stage. This means that credit decisions can be made efficiently and automatically on the basis of specific processes.

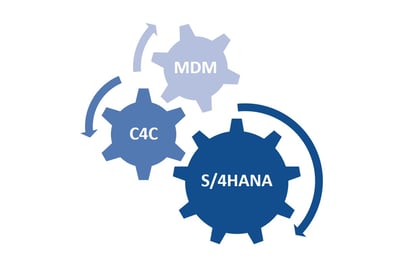

The SAP Credit Management module will be introduced as part of an SAP S/4HANA conversion, or data from the old credit management modules (FI-AR-CR and SD-BF-CM) will be migrated to the new SAP Credit Management.

For this purpose, technical system settings corresponding to your requirements as well as customizing activities − both in SAP Business Partner and in SAP Credit Management − must be carried out in advance. Furthermore, the integration of SAP Credit Management with the FI and SD modules must be set up.

Support/implementation of basic technical configuration

Business partner customizing for credit management

Preparatory activities and migration

Customizing of credit limit checks

Customizing of the integration with accounts receivable

Customizing of integration with sales and distribution

Customizing of case management

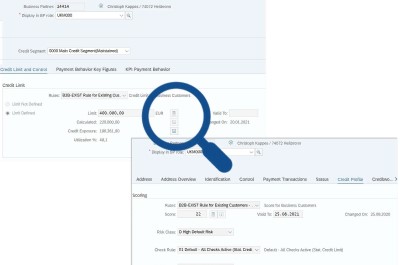

Automatic calculation of creditworthiness in SAP Business Partner (creation of ScoreCard)

Automatic calculation of credit information in SAP Business Partner

Rebuilding of the commitment in SAP S/4HANA after migration

Mapping of different test scenarios

Credit management processes, such as determining and evaluating the creditworthiness of business partners, proposing credit limits, notifying clerks, and monitoring credit limits, can be automated for each business partner.

Credit management processes, such as determining and evaluating the creditworthiness of business partners, proposing credit limits, notifying clerks, and monitoring credit limits, can be automated for each business partner.

External information for determining the creditworthiness of business partners can be automatically queried via corresponding XML interfaces and further used in SAP Credit Management. Information from external data sources such as Creditreform can be transferred and used. Address data can be checked and supplemented using EVIMENDO.external_services.

External information for determining the creditworthiness of business partners can be automatically queried via corresponding XML interfaces and further used in SAP Credit Management. Information from external data sources such as Creditreform can be transferred and used. Address data can be checked and supplemented using EVIMENDO.external_services.

Efficient credit management reduces the risk of payment defaults and thus makes a positive contribution to the operating result. SAP Credit Management in SAP S/4HANA supports companies in structuring and optimizing credit management processes.

PROFI Engineering Systems AG, a medium-sized IT solutions company based in Darmstadt, has successfully migrated to SAP S/4HANA. As implementation partner, IBsolution supported the system conversion in a brownfield approach.

Since most companies already have an ERP system in use, the system conversion is the most common migration scenario to SAP S/4HANA. It is significantly less costly and time-consuming than a new implementation or a landscape transformation.